Introduction: The Solar Panel Price Shock

Something strange happened to solar panels last year.

For almost a decade, prices kept dropping. Every year, going solar becomes cheaper. It was predictable. Reliableeven. Then December 2025 hit, and everything changed.

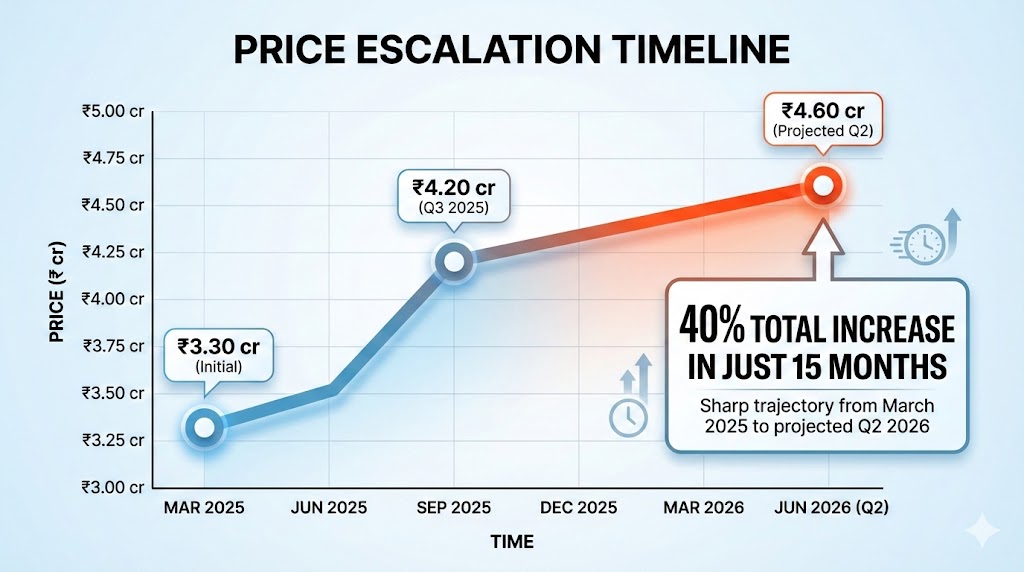

In just nine months, the cost of setting up a 1 MW solar project jumped from ₹3.3 crores to ₹4.6 crores. That’s a40% increase. Not over five years. Not gradually. In nine months.

If you’ve been thinking about going solar, you’ve probably noticed. Quotes from last year don’t match quotestoday. And honestly? They won’t match quotes next month either.

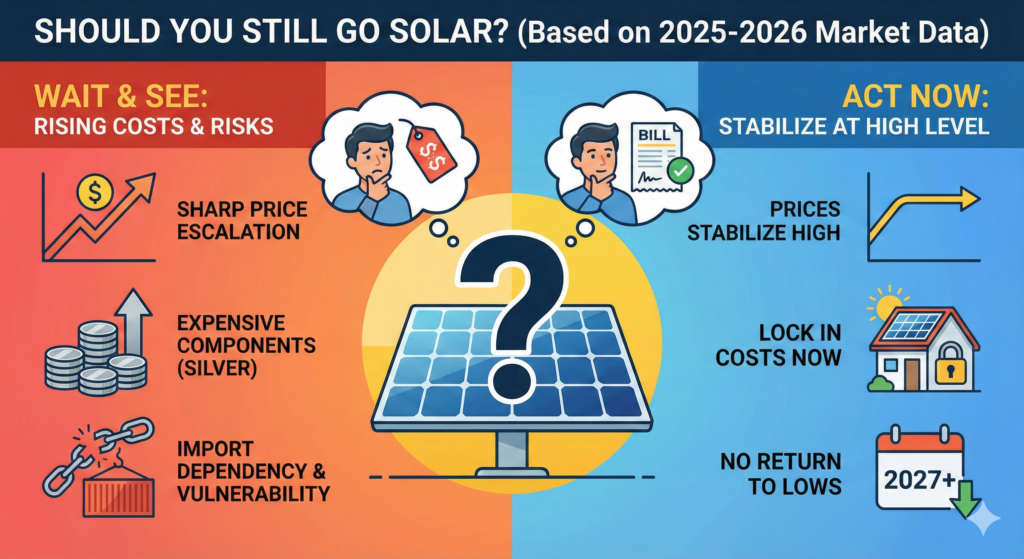

This isn’t a temporary spike. It’s not going to “correct itself” in a few weeks. What we’re seeing is a completereset of how solar panels are priced globally. And India is feeling it harder than most countries.

Here’s what you need to know. Why is it happening? What it means for your home or business. And most importantly, what you can do about it right now.

Because waiting won’t make this better.

Section 1: The Numbers Don’t Lie – How Much Prices Have Actually Risen

Let’s get specific about what “prices going up” actually means.

Between late December 2025 and mid-January 2026, photovoltaic cell prices in India went from 3.5 cents perwatt to 5.5 cents per watt. That’s a 57% jump in less than a month. Not a typo. Fifty-seven percent.

Module prices followed right behind, climbing 33% in the same period.

Here’s the timeline that matters:

March 2025: A 1 MW solar EPC project cost ₹3.30 crores

January 2026: Same project now costs ₹4.20 crores (27% more)

April-June 2026: Projected to hit ₹4.60 crores (40% more than March 2025)

For residential customers, this translates differently but hurts just as much. A typical 5 kW rooftop system thatwould have cost you around ₹2.5 lakhs last March? You’re looking at ₹3.5 lakhs or more today.

[TABLE 1: Cost Impact by System Size]

| System Size | March 2025 Price | January 2026 Price | Increase |

| 3 kW (Small Home) | ₹1,50,000 | ₹2,10,000 | ₹60,000 (40%) |

| 5 kW (Medium Home) | ₹2,50,000 | ₹3,50,000 | ₹1,00,000 (40%) |

| 10 kW (Large Home/Small Business) | ₹5,00,000 | ₹7,00,000 | ₹2,00,000 (40%) |

| 50 kW (Commercial) | ₹25,00,000 | ₹35,00,000 | ₹10,00,000 (40%) |

The math is brutal. Every month you wait, the price climbs higher.

Some developers in Saudi Arabia reported 43% increases in a single week for their projects. India’s not quite that extreme, but we’re heading in the same direction.

And before you ask, no, this isn’t just one company raising solar panel prices. This is happening across the board. Everymanufacturer. Every supplier. Every installer.

The entire supply chain is repricing itself.

Section 2: Why Are Solar Panels Suddenly So Expensive?

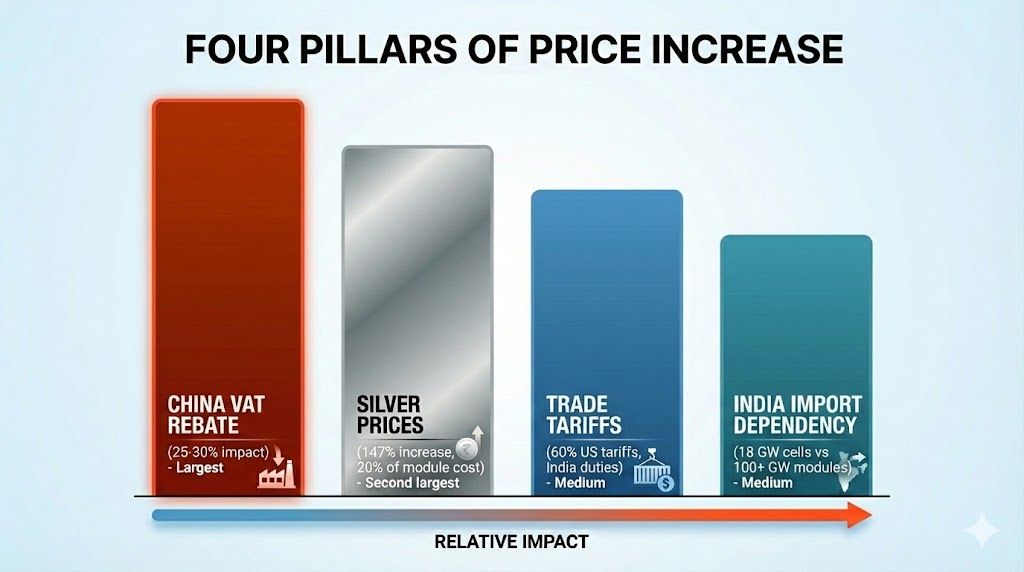

Four big reasons. And they’re all hitting at once.

Factor 1: China Just Changed Everything

China makes most of the world’s solar panels. Not some. Most. And for years, the Chinese government gavesolar manufacturers a sweet deal through VAT export rebates. Basically, the government paid part of the cost to make Chinese solar panels cheaper globally.

That deal is ending. On April 1, 2026, the rebates go away completely.

According to industry analysis from Strategic Energy EU, this policy shift will add 25-30% to solar panel costs permanently.

Here’s what happened: China reduced the rebate from 13% to 9% back in December 2024.

Now they’reeliminating that last 9%. That 9% gets added directly to export prices. And guess who pays? Everyone buyin gsolar panels.

But there’s more. Because everyone knows the deadline is April 1st, there’s a massive rush to buy panels nowbefore prices jump again. Chinese suppliers are rationing supply. Creating artificial scarcity.

Pushing priceseven higher in the short term.

This isn’t a market fluctuation. It’s China restructuring its entire solar export strategy.

Factor 2: Silver Prices Have Gone Absolutely Crazy

Here’s something most people don’t know: every solar panel needs silver. The metal conducts electricity insidethe panel. There’s no cheap substitute that works as well.

And silver prices just hit an all-time high of $94.73 per ounce in January 2026.

That’s a 147% increase in just 2025 alone. One year. Nearly tripled.

Why does this matter? Silver now makes up about 20% of the total cost of making a solar panel. It usedto be only 5% back in 2023. That’s a fourfold increase in cost share.

The solar industry is consuming silver at a rate faster than miners can extract it from the ground. By 2050, solar panels couldconsume up to 98% of all known silver reserves if current trends continue. That’s not speculation, that’s what thenumbers show.

Manufacturers are trying to use less silver per panel. They’ve cut usage by 20% already. But there’s a limit. Use too little silver and the panels don’t work as efficiently. You can’t eliminate it.

Copper might work as a substitute in some new technologies, but those won’t be ready at scale until 2030 at theearliest. Right now, we’re stuck with silver. And silver is expensive.

Factor 3: Trade Wars Are Making Everything Complicated

The US and China are in a full-blown trade war over solar products.

US tariffs on Chinese solar components have reached 60% in some cases. That’s not a competitive tariff, that’s awall. The US doubled tariffs on polysilicon and wafers from 25% to 50% in January 2025. Then added another10% “reciprocal energy tariff” in February.

But here’s where it gets messy for everyone, including India.

Chinese manufacturers tried to dodge US tariffs by manufacturing in Vietnam, Malaysia, Thailand, andCambodia. So the US slapped tariffs on those countries, too. Some as high as 3,500%. Yes, that’s the realnumber.

This creates a domino effect. When one country puts up trade barriers, others follow. The EU is considering similar tariffs. India has its own anti-dumping duties on solar glass imports from China and Vietnam at $664 permetric ton.

Trade wars fragment supply chains. They make everything more expensive for everyone. And solar panels arecaught right in the middle.

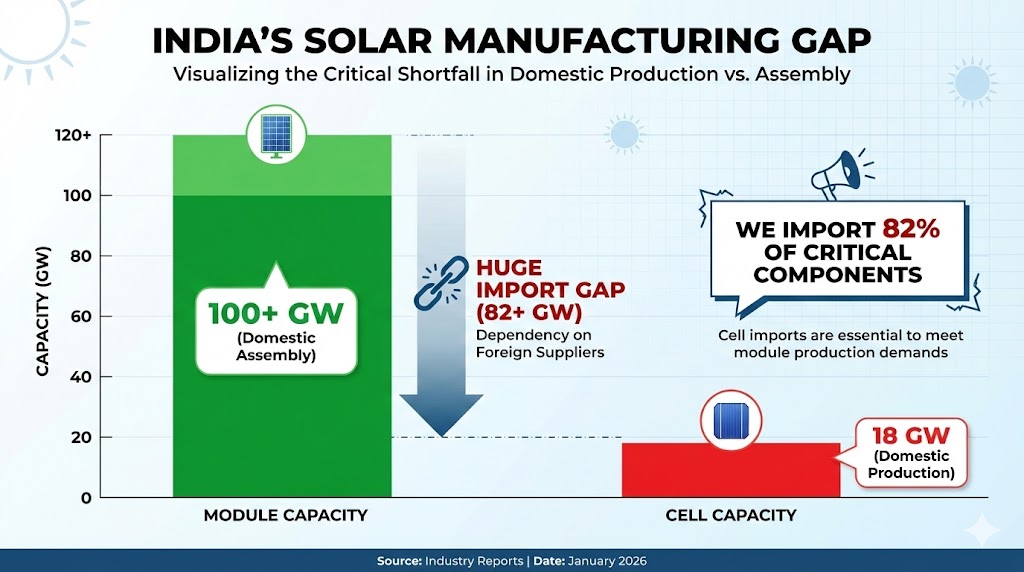

Factor 4: India’s Stuck in a Tough Spot

India has over 100 GW of solar module manufacturing capacity. Sounds great, right?

But here’s the problem: we only have 18 GW of solar cell manufacturing capacity. Cells are what go inside modules. They’re the actual part that makes electricity.

So India imports most of its solar cells. From where? Mostly China.

That means we’re exposed to every problem we just talked about:

China’s policy changes? We feel it.

Silver price increases? We pay it.

Global tariffs? We absorb them.

Rupee weakness against the dollar? That makes imports even more expensive.

India is heavily dependent on imports for polysilicon, ingots, wafers, cells, and silver.

The rupee has weakened, making all these dollar-denominated imports cost more in rupee terms.

We’re vulnerable because we don’t control enough of our own supply chain yet.

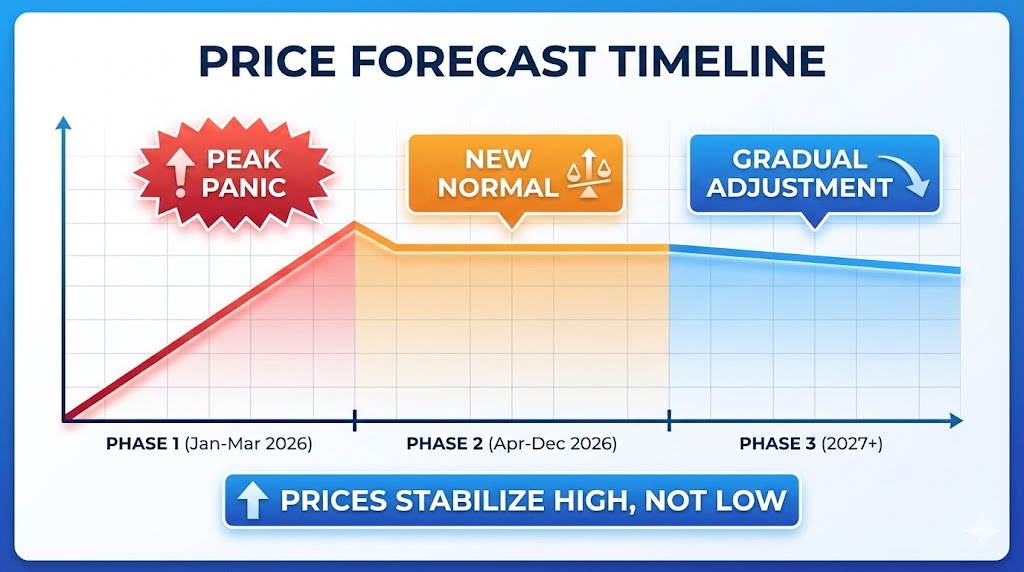

Section 3: Is This Temporary or the New Normal?

Everyone wants to know: Will solar panel prices come back down?

Short answer: not really.

Let’s separate what’s temporary from what’s permanent.

[TABLE 2: Temporary vs Permanent Price Drivers]

| Factor | Temporary or Permanent? | Timeline |

| Pre-April buying rush | Temporary | Ends April 2026 |

| Spot market volatility | Temporary | Stabilizes Q2 2026 |

| China VAT rebate elimination | PERMANENT | Forever |

| Silver scarcity | PERMANENT | 5-10 years minimum |

| Trade war tariffs | PERMANENT | Years to decades |

| Technology transition costs | Semi-permanent | 2-3 years |

| India’s import dependency | PERMANENT | 3-5 years to fix |

What Will Change:

The panic buying before April 1st will calm down. Right now, everyone’s rushing to order panels before China’sVAT rebate disappears. That’s creating an artificial shortage. After April, that rush ends.

Spot market volatility will settle. Solar Panel Prices won’t swing 10-15% in a week anymore. We’ll see more stable pricing, even if that stability is at a higher level.

What Won’t Change:

China’s subsidy elimination is permanent. Once those VAT rebates are gone, they’re not coming back. That 25-30% cost increase is now baked into the baseline price.

Silver scarcity is structural.

Solar panel demand is growing faster than silver mining can keep up. Unless wefind massive new silver deposits or invent a working alternative, silver stays expensive. And that’s a 5-10 yearproblem minimum.

Tariff walls aren’t going anywhere. US-China trade tensions aren’t getting resolved anytime soon. India’s anti-dumping duties will stay in place.

Global supply chains are fragmenting, and that costs money.

Technology transitions cost money upfront. The industry is moving from older PERC technology to newerTOPCon and HJT technologies. These are more efficient but require new manufacturing lines. Manufacturersare shutting down old factories and building new ones. During that transition, supply stays tight.

According to analysis from Now.

Solar, experts across the industry agree: “the era of artificially cheap modulesis definitively coming to an end”[4]. This isn’t one analyst’s opinion. It’s industry consensus.

Rafael Jiménez of VIRA Energy puts it bluntly: current prices represent “a return to real cost logic after a yearof artificial pricing in 2025.”

Translation: the cheap prices we saw in 2025 were actually too low.

Unsustainably low. What we’re seeing nowis what solar panels actually cost to make without government subsidies propping up prices.

Is the era of solar panels getting 5-10% cheaper every year? That’s over.

Section 4: What This Means for Your Solar Investment

Let’s get practical. How does this affect you?

For Homeowners:

That 5 kW rooftop system you were planning? It’s going to cost ₹75,000 to ₹1 lakh more than it would have lastyear. Maybe more, depending on when you buy.

Your payback period just got longer. If your system was going to pay for itself in 5 years, it might now take 6-7years. The math still works out, but it’s not as attractive as it was.

[TABLE 3: ROI Comparison – Then vs Now]

| Metric | March 2025 | January 2026 | Change |

| 5 kW System Cost | ₹2,50,000 | ₹3,50,000 | +₹1,00,000 |

| Annual Savings (₹8/unit, 15 units/day) | ₹43,800 | ₹43,800 | Same |

| Payback Period | 5.7 years | 8 years | +2.3 years |

| 25-Year Total Savings | ₹8,45,000 | ₹7,45,000 | -₹1,00,000 |

| Still Profitable? | ✓ Yes | ✓ Yes | Math works |

Here’s the thing, though: your electricity bill isn’t getting cheaper. Grid power rates keep climbing. So even withhigher upfront costs, solar still saves you money long-term. Just not as dramatically as before.

For Businesses:

Commercial projects are getting squeezed hard. Module costs make up 50% or more of total project costs. When modules jump 33%, your total project cost increases by 15-20%.

If you had a quote from last year, forget it. That number is obsolete.

Businesses that were on the fence about going solar? The economics just got tougher.

ROI calculations need tobe completely redone. Projects that made sense at ₹3.30 crores per MW might not make sense at ₹4.60 croresper MW.

For companies with long-term power purchase agreements already signed, this is a crisis.

The contracted pricedoesn’t cover the new cost structure. Developers are losing money on projects they committed to before pricesjumped.

For Developers:

India has 93 GW of solar capacity under construction right now. But 43 GW of that doesn’t have long-term purchase agreements. That’s merchant solar, which means selling power on the open market.

With costs up 40%, merchant solar is barely profitable. In some cases, it’s not profitable at all anymore.

Distribution companies are already selling renewable energy below cost during peak solar hours because there’soversupply.

Add higher construction costs to that equation? Many projects won’t get built.

Government targets for 300 GW of solar by 2030 just got more expensive to achieve. Either tariffs go up toreflect reality, or project pipelines slow down.

Section 5: When Will Solar Panel Prices Come Down?

Here’s the timeline that matters.

Short-Term (January-March 2026):

Prices will keep climbing. The rush to buy before April 1st creates the worst conditions. Suppliers know buyersare desperate. They have pricing power. Expect continued increases through March.

March might be the worst month. Everyone is trying to lock in orders before the VAT rebate disappears. Limitedsupply. Maximum demand. That’s when prices peak.

Medium-Term (April-December 2026):

After April 1st, the panic subsides. The market adjusts to the new cost structure with Chinese VAT rebates gone. Prices stabilize.

But stabilize doesn’t mean drop. It means they stop climbing so fast. The new stable price is 25-30% higher than2025 levels.

That becomes the new normal.

Long-Term Outlook:

Silver prices come down only if new mines open up (takes years), or solar demand drops (unlikely), or copper substitutes work at scale (not before 2030).

India develops more domestic cell and polysilicon capacity to reduce imports (requires years of investment).

Technology transitions are complete, and new manufacturing lines reach full efficiency (2-3 years minimum).

None of these happens quickly. We’re looking at a multi-year timeline before costs drop meaningfully.

The bottom line: if you’re waiting for solar panel prices to go back to 2024 levels, you’ll be waiting a very long time.Possibly forever.

Section 6: Smart Strategies to Navigate Rising Costs

So what do you actually do with this information?

If You’re Ready to Buy Now:

Lock in pricing before April 1st if you possibly can. Get a quote. Sign a contract. Put down a deposit. Whateverit takes to secure current pricing before the VAT rebate elimination hits.

Every week you wait costs money.

Don’t chase the absolute lowest price. Focus on quality and reliability.

Cheap panels from unknown suppliersmight be cheap for a reason. With supply chains this disrupted, working with established partners who canactually deliver matters more than saving 5%.

Explore financing options. Even at higher solar panel prices, solar can be cash-flow positive from day one if you structurefinancing right. Don’t let upfront cost be the only factor in your decision.

If You Need More Time:

Get multiple quotes now. Understand what the current market looks like. Build relationships with reliableinstallers before you need them.

Don’t wait for a price drop that isn’t coming.

Make your decision based on long-term value, not short-term solar panel price movements.

Consider your electricity bill trajectory.

If your utility rates are climbing 5-8% per year, the case for solar getsstronger even with higher panel costs. Run the numbers based on your actual situation.

The Healthysun Energy Advantage:

We’re not here to pressure you. We’re here to give you honest information so you can make smart decisions.

Our team has direct relationships with reliable manufacturers.

We’re not at the mercy of spot market pricing likesmaller installers. We can offer more stable pricing and guaranteed delivery timelines.

We’ll walk you through the actual economics of your project. Real payback periods based on current costs andyour specific electricity usage. No inflated savings projections. Just math.

Quality matters more than ever right now. We only work with Tier 1 manufacturers whose panels we’d install onour own homes. With supply chains this disrupted, that reliability is worth paying for.

Section 7: The Bottom Line – Should You Still Go Solar?

Yes. Here’s why.

Even at higher solar panel prices, solar still makes financial sense for most homes and businesses. Grid electricity rateskeep climbing. Solar panels keep producing. The math works.

But you need to be strategic about timing and realistic about expectations.

The solar panels you buy today will produce electricity for 25+ years. That’s 25 years of protection againstelectricity rate increases. 25 years of predictable energy costs. That value doesn’t change just because upfrontcosts went up.

Climate benefits haven’t changed either. Every kilowatt-hour your panels produce is one less kilowatt-hour fromcoal or gas. If environmental impact matters to you, that’s still true regardless of solar panel price.

Energy independence has value beyond pure ROI. Not being completely dependent on the grid. Having backup power options. Controlling your own energy production. Those benefits are hard to quantify but very real.

Government incentives and net metering are still available. Subsidies haven’t disappeared. The policyenvironment in India still favors solar. Take advantage while you can.

But here’s what’s different now: you need to act intentionally, not emotionally.

Don’t buy solar because you’re afraid of missing out. Buy it because the numbers work for your specific situation. Do the math. Understand your payback period. Make sure the investment makes sense.

Don’t wait for perfect conditions. Perfect conditions aren’t coming. Solar Panel Prices in 2027 will almost certainly behigher than today, not lower.

Work with experienced installers who understand the current supply chain situation. Someone who can actuallydeliver panels, not just sell you promises. Someone who’s been through tough markets before.

Your Next Steps:

The solar market has reset. Solar Panel Prices are higher. They’re staying higher. That’s the reality.

But solar still works. It just requires smarter decision-making.

If you’ve been thinking about going solar, now is the time to get serious. Get quotes. Run the numbers. Understand your options. Make a decision based on facts, not fear or hope.

Contact Healthysun Energy for a free, no-pressure assessment. We’ll show you exactly what solar would cost for your home or business right now. What your actual savings would be. What does your payback period look like with current pricing?

No sales pitch. Just honest numbers and straight talk.

Because the best time to go solar was last year. The second-best time is today.

References

[1] Strategic Energy EU – “The era of ultra-cheap solar panels is ending as prices set to rise up to 15% in 2026”

[2] PV Magazine – “Silver price hits all time high of $94.73 an ounce”

[3] Saur Energy – “India Imposes 5-Yr Anti-Dumping Duty on Solar Glass Imports”

[4] Now.Solar – “An increase in the price of solar panels in 2026 is becoming increasingly certain”

[5] Scanx Trade – “Solar Module Prices Surge 33%”